Resolute U helps Australians build financial clarity through life’s transitions

We provide structured financial education, small-group programs, and a supportive community — so you can make confident decisions without pressure or guesswork.

Money decisions don’t happen in isolation. They sit inside real life — work, family, relationships, stress, and change.

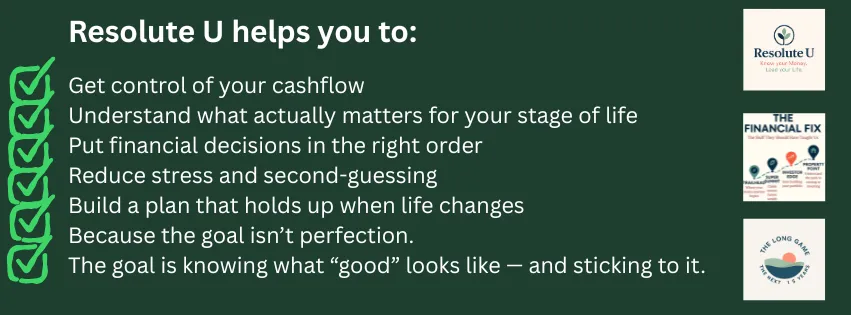

Resolute U gives you:

clear priorities

practical systems

and people who are on the same path.

Structure. Support. Direction.

Know your money - Lead your Life.

There will always be competing priorities. Money doesn't need to be one of them.

Life isn't slowing down. We don't have more time.

Work, family, relationships, health, unexpected changes — the pressure is real, and it doesn’t come one decision at a time.

Resolute U helps you understand your real financial position, so money stops being another source of stress.

When you know your numbers, have a plan, and build a buffer, something shifts.

You get breathing space.

You make clearer decisions.

And money stops sitting in the background as a constant worry.

Don't forget to check out the Free Resources to assist you on your financial journey.

Know your money. Lead your life

Testimonials

I learnt, through making changes to my Risk Profile, I now look to have an extra $600k in my Super

Trudy

I am a successful business owner, but despite my knowledge, I wasn't able to put it into practice. The Financial Fix, allowed me to take control of my finances.

Kate

“Peace of mind doesn’t come from earning more.

It comes from knowing where you stand and what your next step is.”

Resolute U

Life doesn’t give you one financial decision at a time.

People are overwhelmed by competing priorities and no clear order of what matters first.

Costs grow, standard of living is decreading.

Kids, school, sport, clothes, living expenses.

Property - either renting or own home.

Career pressure.

Ageing parents.

Super.

Investing.

Debt.

Lifestyle.

And somewhere in the background there’s the constant thought:

“Are we actually doing the right things?”

That’s what Resolute U fixes.

We give you structure, sequence, and decision clarity, so you stop guessing and start moving forward with confidence.

Your priorities change. Your Financial strategy should change with them.

At different stages of life, the pressure looks different.

Early career (18-30)

Income growing, but no system yet. Everything feels uncertain.

Messy middle (30s–40s)

Mortgage, kids, lifestyle costs, career pressure. Good income — but no clear plan.

Pre-retirement (40s–50s)

Higher stakes. Less time to correct mistakes. Big decisions about super, investing, debt and lifestyle.

Resolute U is designed to support you through these transitions, with the right structure at the right time.

Work with us

TRAILHEAD

Trailhead – Your Money Map

For anyone, any age, who wants their cashflow sorted.

If your money feels unpredictable, nothing else works properly.

Trailhead gives you a simple system to:

See exactly where your money is going

Reduce financial stress immediately

Build a monthly process you’ll actually stick to

Create breathing room for future decisions

You’ll receive:

The Trailhead budgeting tool

Module 1 of The Financial Fix (Cashflow & Goals)

A private AI assistant designed specifically for budgeting support

A system you can run every month

Investment: $149

Download brochure, click on photo

FOR PEOPLE WHO AREN’T READY (OR CAN’T AFFORD) THE OTHER PROGRAMS

THE FINANCIAL FIX (18–30)

The Financial Fix — Foundations for Young Adults

Real-world money skills for Australians who want to get ahead without guessing.

The challenges at this stage

If you’re in your late teens, 20s or early 30s, the pressure looks like:

Income coming in — but it disappears

Starting budgets and abandoning them

Super you don’t understand

Investing feels confusing or risky

Property decisions feel out of reach or overwhelming

Constant comparison to what everyone else is doing

Most people weren’t taught any of this.

The Financial Fix builds the foundations — in the right order.

What the program gives you

Over 4 months you’ll build:

A simple cashflow system that actually sticks

Clear financial priorities

Understanding of super and long-term impact

Investing fundamentals without hype or speculation

A framework for property decisions (rent, buy, wait)

This isn’t about becoming a finance expert.

It’s about feeling capable and in control.

Investment: $660

Download brochure, click on photo

Are you ready to take control of your Financial Future?

THE LONG GAME (40–55)

The reality at this stage

You might have:

A good income — but constant pressure on where it goes

A mortgage, school costs, and rising lifestyle expenses

Super and investing sitting in the background

Career uncertainty, burnout, or a plateau

Ageing parents starting to need support

And in the back of your mind:

“We should probably have a proper plan.”

That The Long Game gives you

This program helps you:

Set clear priorities for the next 10–15 years

Understand what you can realistically afford to do

Put your decisions in the right sequence (what first, what next, what can wait)

Align cashflow, debt, super and investing

Build a roadmap you actually understand — and can follow

Because this stage isn’t about doing more (you already are doing enough).

It’s about doing the right things, in the right order.

12 weeks | Max 10 participants | Suitability call required

Investment

$3,300 single

$3,850 couple

Download brochure, click on photo

Are you ready for your Retirement?

RESOLUTE U Blog, NOTES ON THE TRAIL

What is the Financial Fix

What is the Financial Fix, our four month flagship program, join today ...more

The Financial Fix

January 16, 2026•1 min read

5 Common Trail Mistakes

5 Common trail mistakes, and the answer is to join The Financial Fix ...more

The Financial Fix

January 16, 2026•3 min read

Money Overwhelm 101: Finding your feet

New Blog Post Description ...more

Trailhead

January 16, 2026•2 min read

Get In Touch

Email: [email protected]